GCC tax leaders prioritise AI quality over efficiency

Data fragmentation emerges as primary adoption bottleneck in Deloitte survey

#GCC #finance – Tax and finance leaders across the Gulf Cooperation Council (GCC) prioritise accuracy and analytical depth over efficiency gains in generative AI adoption. A new survey by professional services firm Deloitte Middle East, has found that 38% focused on improving analysis quality rather than automation when investing in AI. Based on 649 responses from tax and finance leaders across Saudi Arabia, the UAE, Qatar, and Kuwait, the research also revealed that whilst AI has become a leadership priority, 63% of organisations remain in early-stage exploration or pre-implementation phases, with only 19% having reached scaled or enterprise-wide deployment. Fragmented data foundations rather than AI capability have emerged as the primary bottleneck, with 51% identifying data recording, validation, and reconciliation as the most significant sources of manual effort slowing implementation.

SO WHAT? – The Deloitte findings reveal a gap between regional AI ambition and execution capability, with most organisations surveyed uncertain about operating models rather than lacking intent. The emphasis on trust, analytical depth, and decision quality over end-to-end automation suggests Middle East tax functions are taking a more measured approach than early AI hype suggested. However, fragmented data infrastructure is often the bottleneck, not availability of AI solutions, sometimes forcing AI initiatives to compensate for upstream data weaknesses, increasing implementation complexity and extending time to value.

Here are some key points from the new research:

Professional services firm Deloitte, has published a new survey report GenAI in Tax and Finance: GCC Adoption Insights and Execution Realities, which surveyed 649 tax and financial leaders across the GCC.

Whilst AI has become a leadership priority, 63% of organisations surveyed remain in early-stage exploration or pre-implementation phases, with only 19% having reached scaled or enterprise-wide deployment.

Deloitte was able to classify organisations into three categories: the Early-stage Majority (63%) who are exploring or in pre-implementation phases, Scaling and Maturity organisations (19%) who have reached scaled or enterprise-wide AI implementation, and the Implementation Gap (18%) who are actively piloting AI solutions but have not scaled up.

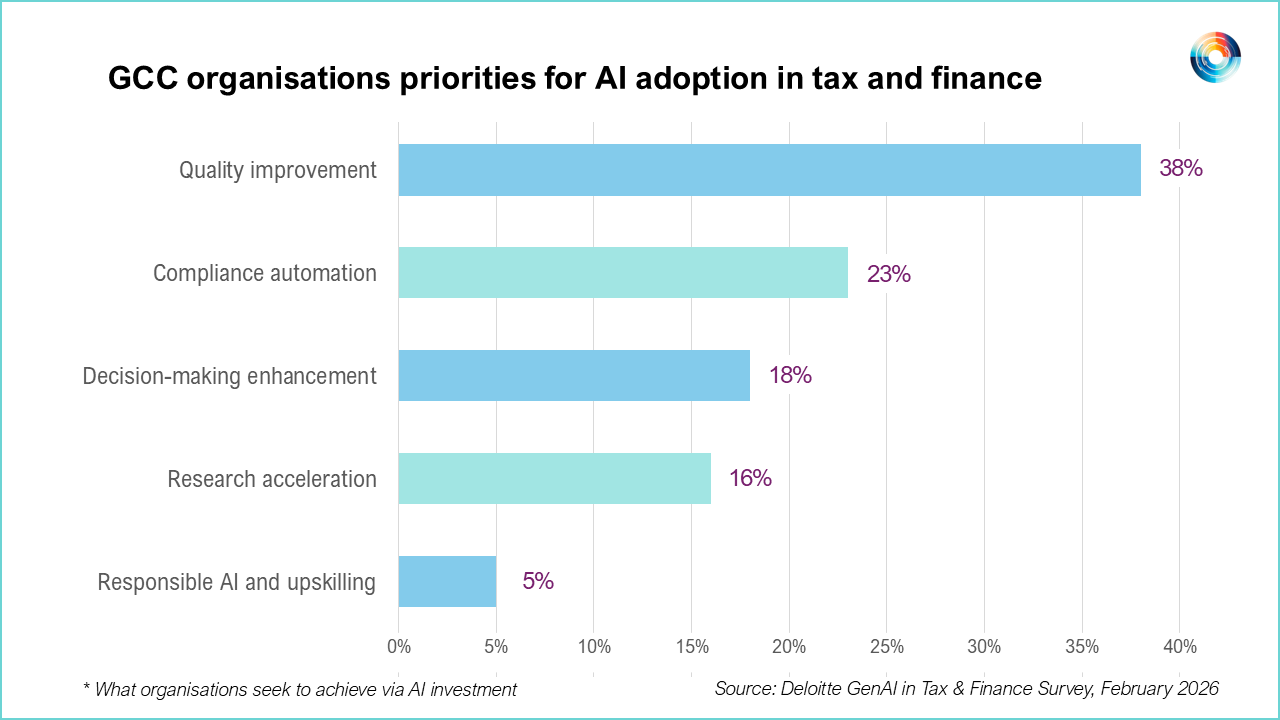

The top five priorities for GenAI adoption in tax and finance functions are quality improvement (38%), compliance automation (23%), decision-making enhancement (18%), research acceleration (16%), and responsible AI and upskilling (5%), revealing a hierarchy that prioritises accuracy over productivity gains.

29% of surveyed organisations have not yet started exploring AI for tax functions, 34% are focused on capacity building or exploring potential options, and 18% are experimenting via pilots or proof-of-concepts, with just 9% scaling AI use cases and 10% having enterprise-wide AI strategy and governance in place.

Research automation represents the highest-impact opportunity according to 27% of respondents, whilst 14% highlight data analysis, confirming that analytical and cognitive work rather than purely transactional tasks drives efficiency concerns amongst tax and finance leaders in the region.

Current GenAI applications in practice include AI tools and platforms such as Microsoft Copilot and ChatGPT (11% of respondents), email management (8%), and various research and data analysis functions, though adoption remains concentrated in exploration rather than scaled deployment.

AI adoption in tax is being justified primarily through accuracy, insight, and defensibility rather than efficiency gains, with 41% identifying research and data analysis as the top areas for automation, whilst data readiness has become the binding constraint on scaling AI value across organisations.

Despite strong intent to adopt AI, 29% of organisations have not started any AI initiatives whilst 39% remain in the exploration phase when defining AI implementation approaches, reflecting uncertainty around operating models and governance frameworks rather than lack of ambition amongst leadership teams.

The research is based on 649 responses from tax and finance leaders across Saudi Arabia (48%), the UAE (26%), Qatar (16%), and Kuwait (10%).