Presight reports 36.9% revenue growth for 2025

Revenue tops AED 3 billion in FY25 with 12 consecutive quarters of growth

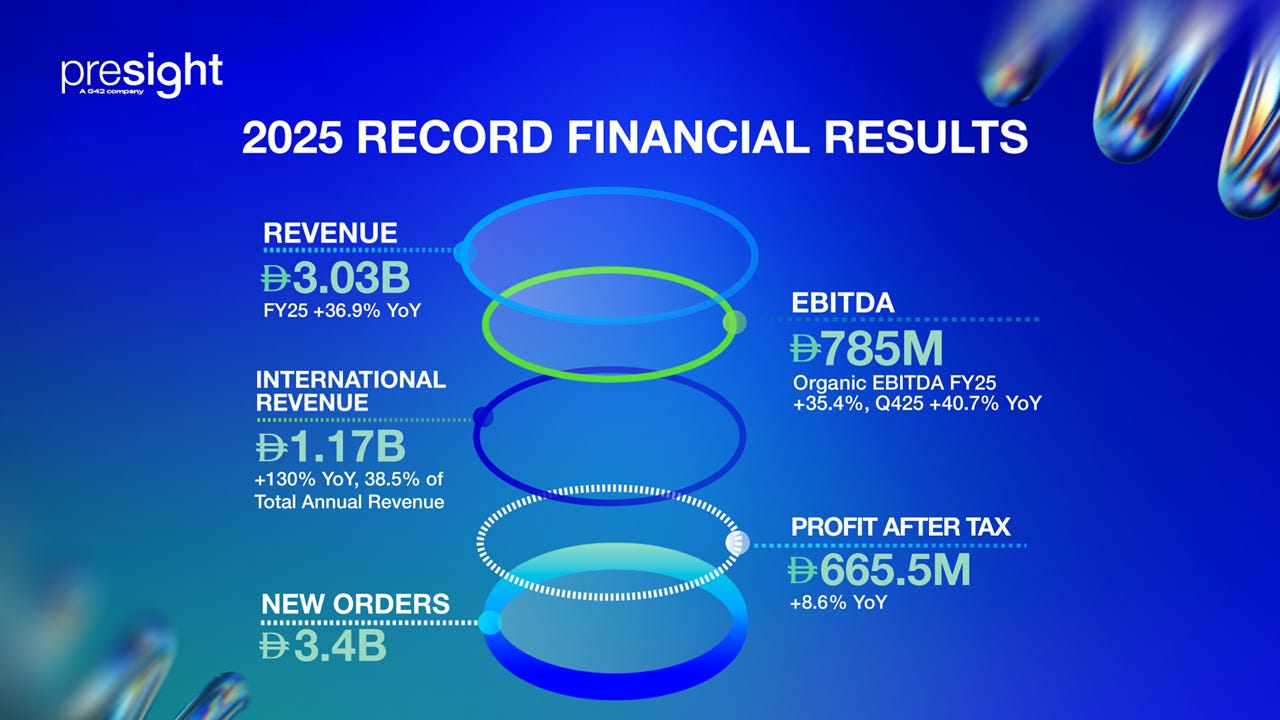

#UAE #ADX – Presight AI Holding PLC, listed on Abu Dhabi Securities Exchange as ADX: PRESIGHT, today announced its financial results for the full year ending December 31st, 2025. The G42 majority-owned AI and big data analytics company reported revenue of AED 3.03 billion ($825 million) for the year, representing growth of 36.9 percent year-on-year and marking the company’s 12th consecutive quarter of strong growth since its 2023 initial public offering. Presight reported international revenue increased 130 percent year-on-year to AED 1.17 billion, accounting for 38.5 percent of total annual revenue compared with 23% in 2024, whilst EBITDA rose 23.5% to AED 785 million and profit after tax increased 8.6 percent to AED 665.5 million despite the full-year impact of the UAE’s 15 percent corporate tax. The company raised its medium-term guidance for 2025 to 2029, targeting revenue compound annual growth rate of 20-25 percent, EBITDA CAGR of 23-28 percent, and profit after tax CAGR of 21-26 percent.

SO WHAT? – The international expansion demonstrates growing demand for Presight’s sovereign AI deployment model across emerging markets, with the fourth quarter recording 55 percent year-on-year international revenue growth representing 46.5 percent of quarterly revenue. By securing AED 3.4 billion in new orders during FY25 and maintaining a closing backlog of AED 3.4 billion (a 13 percent increase year-on-year and 85.1 percent increase over three years) Presight has established visibility for sustained growth whilst maintaining a debt-free balance sheet. The performance validates the company’s strategy of applying intelligence across sovereign and enterprise deployments in high-growth emerging markets rather than competing primarily in mature Western markets.

According to a Presight media statement 2025 business highlights include:

ADX-listed Presight AI Holding PLC (ADX: PRESIGHT) today announced its financial results for the full year ending December 31st, 2025.

Organic revenue grew 25% for the full year, reflecting continued execution across international multi-year deployments and sectoral diversification, whilst Q4 2025 delivered Presight’s strongest fourth quarter organic revenue growth to date and second highest quarterly organic growth rate since the company’s IPO.

The fourth quarter recorded revenue of AED 1.29 billion, up 23.6% year-on-year, and EBITDA of AED 407.6 million, up 11.3%, supported by favourable organic deployment mix, continued international momentum and disciplined execution across major programmes.

FY25 organic EBITDA increased 35.4% year-on-year, whilst Q4 organic EBITDA grew 40.7%, marking the strongest quarterly organic EBITDA performance since the company’s IPO, with growth supported by execution of multi-year deployments across Jordan, Kazakhstan and Albania.

Since its IPO in 2023, Presight has achieved compound annual growth in revenue of 25% with an average EBITDA margin of 27.7%, notwithstanding significant greenfield expansion and strategic investment in innovation and talent across international markets.

On a like-for-like basis applying the prior-year 9% tax rate, profit after tax would have grown 16.7% year-on-year, demonstrating underlying operational performance before the impact of the UAE’s introduction of federal corporate tax in 2023.

Presight’s majority-owned subsidiary AIQ contributed materially to FY25 performance following a full year of consolidation, with AIQ continuing to strengthen its position in the energy sector, which remains a growth sector for the company.

ZOOM OUT – Presight’s FY25 financial results shatter its previous FY24 record performance, when the ADX-listed company reported revenue of AED 2.21 billion ($600m) with 24.3% year-on-year growth, adding approximately AED 430 million in absolute annual revenue. In comparison, FY’25’s 36.9% year-on-year growth with reported revenue of AED 3.03 billion ($825m) is another big leap forwards. Over the past two years, international revenue has grown from being an indicator for expansion to a core growth engine. The contribution of international to revenue has risen from AED 508 million in FY’24 representing 23%, to AED 1.17 billion in FY’25 accounting for 38.5% of the revenue mix. Overall, international revenue showed extreme growth of 130% year-on-year, following a 3.5-fold jump from 2023 to 2024. The quality of revenue also shows continued improvement through multi-year sovereign programmes, with FY25 organic revenue growth of 25% driven by live deployments across Jordan, Kazakhstan and Albania. Presight’s result reflect efforts to expand its global business via a layered approach that promises sustained growth.

LINKS

Presight 2025 results press release (Presight)

Presight investor information (Presight)

Read about Presight’s 2024 financial results:

Presight FY 2024 revenue grows 24% (Middle East AI News)