QIA takes part in Positron $230M Series B funding round

Series B round now values Nvidia challenger above $1 billion

#UnitedStates #Qatar #funding – Nevada-based AI chip startup Positron AI has raised $230 million in a Series B funding round that values the company at more than $1 billion, positioning it as a competitor to Nvidia in the AI inference hardware market. The oversubscribed round was co-led by California-based private wealth firm ARENA Private Wealth, Chicago-based quantitative trading firm Jump Trading, and venture capital firm Unless, with strategic investments from Qatar’s sovereign wealth fund the Qatar Investment Authority (QIA), UK-based semiconductor designer Arm Holdings, and impact investment firm Helena. The funding will accelerate development of Positron’s next-generation Asimov chip, targeting tape-out in late 2026 and production in early 2027, with the company claiming 5x better energy efficiency and six times more memory capacity than Nvidia’s upcoming Rubin GPU.

SO WHAT? – The funding validates growing market interest energy-efficient AI chips, as inference drives massive demand for AI compute and power consumption emerges as a critical bottleneck deployment. Positron’s approach addresses two key infrastructure constraints: energy availability and memory capacity. Its next-generation Asimov chip is designed to deliver 2,304GB of RAM per device compared to 384GB for Nvidia’s Rubin, potentially unlocking new categories of memory-intensive workloads including video processing, multi-trillion parameter models, and applications requiring enormous context windows.

MENA FOCUS - The Series B funding announcement also signals Positron’s new focus on the Middle East and North Africa, with its CEO Mitesh Agrawal delivering the news personally at the Web Summit Qatar this week. The company appointed Husni Khuffash (ex-Aixplain, EY and Microsoft) in December as its MENA business lead. As Positron’s first public outing in the region, Agrawal and Cameron McCaskill, head of sales, joined Khuffash for the Web Summit Qatar, meeting with senior officials from key government departments and state companies. So, it was not coincidental that QIA made a strategic investment via the funding round.

Here are some key points about Positron’s funding round:

AI chip startup Positron AI has raised $230 million in a Series B funding round that now values the company at more than $1 billion.

The oversubscribed round was co-led by California-based private wealth firm ARENA Private Wealth, Chicago-based quantitative trading firm Jump Trading, and venture capital firm Unless, with strategic investments from Qatar’s sovereign wealth fund the Qatar Investment Authority (QIA), UK-based semiconductor designer Arm Holdings, and impact investment firm Helena.

The Series B financing also included participation from existing investors Valor Equity Partners, Atreides Management, California-based DFJ Growth, Resilience Reserve, Flume Ventures, and 1517, demonstrating continued confidence from Positron’s original backers alongside the new strategic partners.

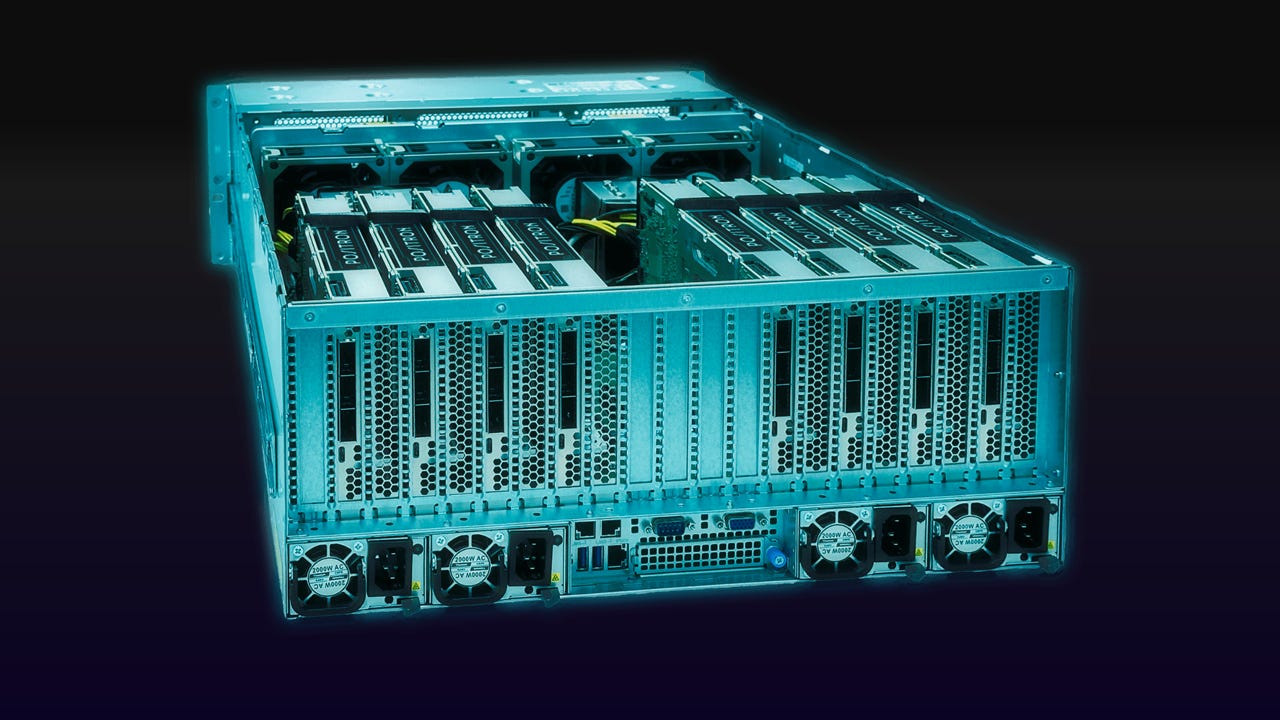

Positron’s shipping product Atlas is an inference system designed for rapid deployment and scaling, marketed as fully American-fabricated and manufactured silicon enabling fast production ramp and dependable supply for customers requiring capacity quickly, addressing potential supply chain concerns in the AI infrastructure market.

Chicago-based quantitative trading firm Jump Trading co-led the investment round after first deploying Atlas systems as a customer, with the company reporting roughly 3x lower end-to-end latency than comparable Nvidia H100-based systems on evaluated inference workloads in an air-cooled, production-ready footprint.

The next-generation Asimov chip is designed around a memory-first architecture to support 2 terabytes of memory per accelerator and 8 terabytes per Titan system, translating to memory capacity exceeding 100 terabytes at rack scale, addressing the reality that modern AI workloads are increasingly limited by memory bandwidth and capacity rather than compute performance.

Positron claims its Asimov chip will deliver 5x more tokens per watt in core workloads versus Nvidia’s upcoming Rubin GPU, whilst maintaining similar realised memory bandwidth, with the architecture designed to unlock high-value inference workloads including long-context large language models, agentic workflows, and next-generation media and video models.

The company is targeting tape-out of the Asimov chip just 16 months after its June Series A financing provided resources to launch the design process, with plans to maintain this development pace for future chips as a competitive advantage against Nvidia’s shipping frequency.

Positron expects strong revenue growth in 2026, positioning itself to become one of the fastest-growing silicon companies ever by achieving large-scale commercial traction roughly 2.5 years from company launch, working with multiple frontier customers across cloud, advanced computing, and performance-sensitive verticals.

The company is building its platform with an ecosystem including UK-based semiconductor designer Arm, California-based server manufacturer Supermicro, and other technology and supply-chain partners, with investment from Arm validating Positron’s memory-centric approach built on Arm technology for delivering scalable performance-per-watt gains.

ZOOM OUT – Middle Eastern sovereign wealth funds and government companies have emerged as major backers of global AI infrastructure vendors, driven by national strategies to lead in AI cloud and data centre services. Meanwhile, AMD, Cerebras, Groq and Nvidia have all formed partnerships with state-backed companies in the GCC, to build out AI data centre capacity. Abu Dhabi-based G42 and California AI chipmaker Cerebras began building a massive global AI supercomputer network in 2023 for training AI models. In early 2025, Groq opened EMEA’s largest AI inference centre in Dammam in partnership with Aramco powered by an initial 19,000 LPUs. Meanwhile, Nvidia has deals with Saudi Arabia’s HUMAIN, Abu Dhabi’s G42 and others to supply hundreds of thousands of its GPUs. So far, the demand for high-end AI infrastructure systems shows no sign of slowing.

[Written and edited with the assistance of AI]