Middle East data centre growth to outstrip global markets

Knight Frank forecasts 62.5% annual growth in Middle East capacity

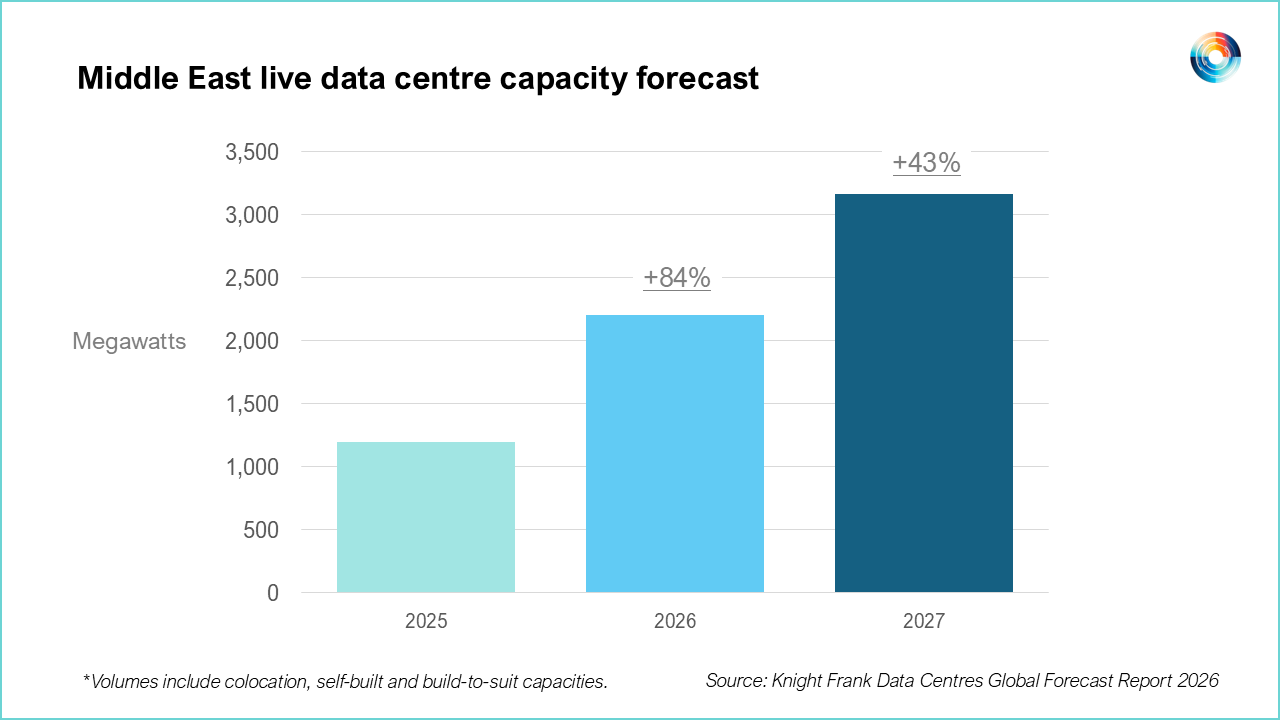

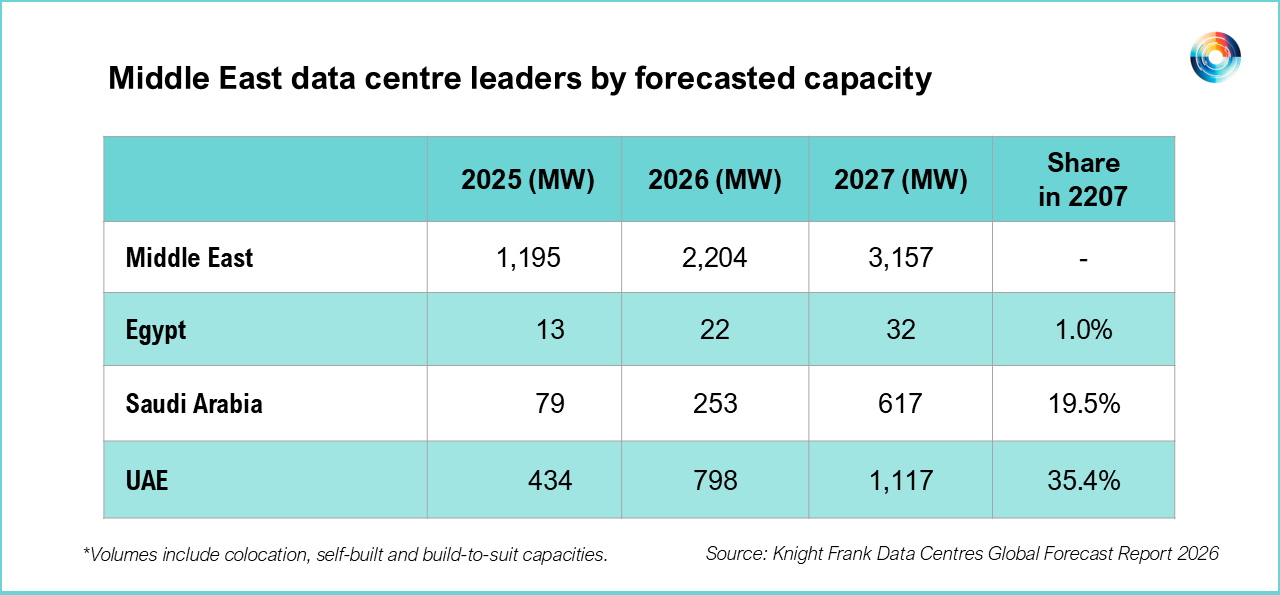

#MiddleEast #UAE #SaudiArabic #datacentres – The Middle East will witness the most dramatic data centre capacity growth globally over the next two years with an annual growth rate of 62.5 percent (CAGR), driven by first-phase energisations of multiple gigawatt-scale campuses across Saudi Arabia and the UAE, according to global property consultancy Knight Frank. The firm’s Global Data Centres Outlook 2026 forecasts Middle East capacity reaching 2.2 Gigawatts (GW) in 2026 and 3.2GW in 2027, compared with 1.2GW at the end of 2025, with combined Saudi Arabia and UAE national data centre market valuations climbing from $35 billion in 2025 to $115 billion by end of 2027. Abu Dhabi is set to become the region’s first gigawatt market in 2027, placing it amongst only 20 gigawatt markets globally with just 10 situated outside North America.

SO WHAT? – The report identifies the Middle East as the world’s fastest-growing data centre region, outpacing North America’s 24.6 percent compound annual growth rate and Europe’s 17.8 percent expansion by several times, in line with the region’s rapid transformation from cloud infrastructure catch-up to AI-first deployment. The projected market valuation surge from $35 billion to $115 billion within two years reflects both capacity growth and premium pricing for AI-optimised infrastructure. However, Knight Frank’s view is that an announced 14GW aspirational capacity will realistically deliver closer to 5GW by the end of the decade. However, fluctuations in projected capacity can be also be expected during the next two years.

Here are some key points from the Knight Frank report:

London-based global property consultancy Knight Frank’s Global Data Centres Outlook 2026 forecasts Middle East data centre capacity reaching 2.2GW in 2026 and 3.2GW in 2027, compared with 1.2GW at end of 2025, representing 62.5% annual growth rate.

The Middle East will see by far the most dramatic growth globally over the next two years, driven by first-phase energisations of multiple gigawatt-scale campuses across Saudi Arabia and the UAE as the region pivots from cloud catch-up to AI-first infrastructure.

Combined Saudi Arabia and UAE national data centre market valuations will climb from $35 billion in 2025 to $115 billion by end of 2027, with Abu Dhabi set to become the region’s first gigawatt market in 2027.

In the next two years, Abu Dhabi will join only 20 gigawatt markets globally, with just 10 situated outside North America, powered by the USA-UAE AI initiative delivering a 5GW multi-tenanted campus spanning 10 square miles using nuclear, gas and solar energy.

Stargate UAE, a 1GW AI compute cluster operated by OpenAI and Oracle alongside partners NVIDIA, Cisco and SoftBank, will see its first 200MW go live in 2026 as part of the Abu Dhabi campus development.

Riyadh will scale at a compound annual growth rate of 85.9% over the next two years with over half a gigawatt of new capacity expected before 2028, spearheaded by PIF-owned AI company HUMAIN targeting 1.9GW by 2030 and 6.6GW by 2034.

Knight Frank analysis indicates that whilst new data centre development announcements over the last 18 months exceeded 14GW, realistic total supply will more likely reflect approximately 5GW before the end of the decade, suggesting significant market oversupply risk.

Globally, 33GW of new data centre capacity is to be delivered over the next two years representing 24.6% compound annual growth rate, with 63% of growth located in North America and Europe expanding at 17.8% annually.

ZOOM OUT – Knight Frank’s Global Data Centres Outlook 2026 forecasts 33GW of new capacity to be delivered globally over the next two years, representing 24.6 percent compound annual growth rate, with global capacity expected to reach 73.6GW in 2026 and 93GW by end of 2027 compared with approximately 60GW currently. North America will account for 63 percent of growth, whilst Europe will expand at 17.8 percent annually with capacity diverging from traditional metropolitan areas as AI demand takes hold. Through analysis of over 2,600 data centre projects globally, Knight Frank identifies three major challenges: power availability as the decisive constraint (particularly in EMEA and APAC regions); liquidity pressures from capital-intensive AI-ready infrastructure with heightened tenant risk from neo-cloud operators; and technological advancement concerns about site adaptability and stranded asset risk from lower redundancy facilities.

[Written and edited with the assistance of AI]

DOWNLOAD

Read more about the Middle East data centre sector:

HUMAIN secures $1.2B AI infrastructure financing (Middle East AI News)

Syntys expands Qatar data centre footprint (Middle East AI News)

Saudi now building world’s largest government data centre (Middle East AI News)

Stc subsidiary, HUMAIN launch AI infrastructure JV (Middle East AI News)

Brookfield, Qai form $20B AI infrastructure venture (Middle East AI News)